Section 15. Global Risks 2024

This Section presents key global risks and foreign policy trends according to the versions of several analytical centers, namely the analysts of the World Economic Forum (WEF), the consulting company Eurasia Group, the Russian Economic News Agency PRIME, and the largest bank company "Charles Schwab".

15.1. Risks 2024 (WEF version)

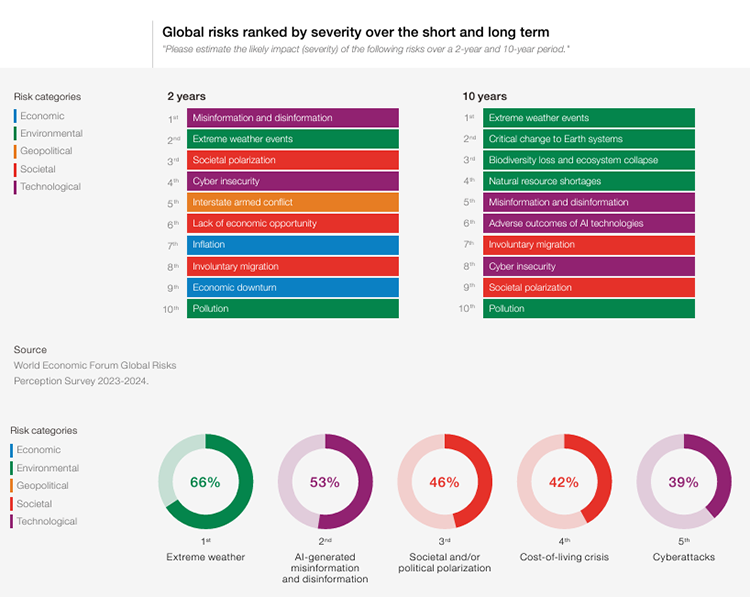

The Global Risks Report analyses global risks over one-, two- and 10-year horizons. According to the annual survey conducted among nearly 1,500 experts from academia, business, government, 30% respondents anticipate a high risk of global catastrophes over the next two years, while more than half of respondents (63%) do not exclude such a scenario over the next decade.

In experts' opinion, the top risks 2024 include:

1. Extreme weather events (66%). Environmental risks, such as climate change, biodiversity loss and natural resource shortages are the top long-term risks and continue dominating in the global risks landscape. Two thirds of the respondents consider extreme weather events as the greatest risk, which is most likely to present a material crisis on a global scale in 2024. Many economies will remain largely unprepared for "non-linear" impacts: the potential triggering of a nexus of several related socio-environmental risks has the potential to speed up climate change, through the release of carbon emissions, and amplify related impacts, threatening climate-vulnerable populations. The collective ability of societies to adapt could be overwhelmed, considering the sheer scale of potential impacts and infrastructure investment requirements, leaving some communities and countries unable to absorb both the acute and chronic effects of rapid climate change.

2. AI-generated misinformation and disinformation (53%). A growing distrust of information, as well as media and governments as sources, will deepen polarized views – a vicious cycle that could trigger civil unrest and possibly confrontation. WEF analysts pay attention to the risk of inaccurate and falsified information in electoral processes in 2024-2025 across several economies, including the United States, Europe, Russia, India, South Africa, Indonesia, the United Kingdom and Mexico. If the legitimacy of elections is questioned, civil confrontation is possible – and could even expand to state collapse in more extreme cases. There is also a risk to global trade and financial markets. The control of dissemination of fakes, in turn, creates risks of repressions, censorship, erosion of human rights and domestic disinformation.

3. Societal and political polarization (46%). Societal polarization features among the top three risks over both the current and two-year time horizons, ranking #9 over the longer term. In addition, societal polarization and economic downturn are seen as the most interconnected - and therefore influential - risks in the global risks network, as drivers and possible consequences of numerous risks.

4. Cost-of-living crisis (42%). Economic uncertainty will weigh heavily across most markets, but capital will be the costliest for the most vulnerable countries.

5. Cyberattacks (39%). Cyberattacks and cybercrime are escalating globally, with the finance, healthcare, IT, and public sectors experiencing the most significant impacts. 2023 witnessed another record year for internet scams, with reported incidents surging by 49% compared to 2022. Cybercriminals are evolving into sophisticated criminal organizations, adapting to new threats, exploiting emerging vulnerabilities, and employing increasingly complex attack vectors.

6. Economic downturn (33%). There's a growing perception that the world is moving away from the principles of globalization. Many countries are prioritizing national interests, focusing on strategies for national security and economic self-sufficiency. This shift is evident in the decline of long-standing international cooperation mechanisms. Nearly 70% of surveyed economists fear a rise in geo-economic fragmentation in 2024. Central banks' rates in different economies will be higher in the next years. Continued high inflation, driven by factors such as de-globalization, demographic shifts, and climate challenges, poses a significant threat to long-term development progress and living standards.

7. Disrupted supply chains for critical goods and resources (25%). Shifts in geopolitical power, economic fragility and limits to the efficacy and capacity of international security mechanisms will remain in the near-term horizon, destabilizing the global financial system and supply chains.

8. Escalation or outbreak of interstate armed conflict(s) (25%). The report notes that the survey was conducted in September 2023, i.e. before the HAMAS' attack to Israel and aggravation of the situation in the Middle East. Nevertheless, the armed conflict related risks were in top five concerns through to 2026 and in the near ten-year horizon. The respondents named three key hotspots – Ukraine, Israel and Taiwan, with possible escalation. If the conflict intensifies, it is still more likely to do so through conventional rather than nuclear means, but it could also expand to neighboring countries. Analysts do not exclude that the war could ‘refreeze' into a prolonged, sporadic conflict that could last years or even decades. If the Israel-Gaza conflict destabilizes into wider regional warfare, more extensive intervention by major powers is possible, including Iran and the West. Frozen conflicts at risk could include the Balkans, Libya, Syria, Kashmir, Guyana, the Kurdish region and Korean peninsula.

15.2. Risks 2024 (Eurasia Group version)

The Eurasia Group consulting company launched its forecast of global risks 2024:

1. Russia vs. Ukraine. American experts predict probably an unexpected outcome of the conflict in Ukraine for the West rather than for Russia. Ukraine is in a more troubled position. Ukraine now stands to lose significant international interest and support. In authors' opinion, Russia can keep control of the territory it now occupies on the Crimean peninsula and in Donetsk, Luhansk, Zaporizhzhia, and Kherson oblasts, i.e. one fifth of Ukraine's territory. Kyiv will be forced to defend, and Russia, being in material and technical advantage, could take more land. It is expected that Ukraine could face setbacks in 2025.

2. Israel vs. HamasС. The Middle East, which is on the brink of a large-scale war, is considered as another major risk by analysts. The current fighting in Gaza is accordingly likely to be only the first phase in an expanding conflict in 2024. One path to escalation would be a decision by Israel to strike Hezbollah in Lebanon. As the war drags on, the schism between Washington and the rest of the world will grow.

3. The United States vs. itself. Experts anticipate another one world conflict - the United States versus itself. Elections in 2024 will be a real test for American democracy. In experts' opinion, the US political system is remarkably divided, and its legitimacy and functionality have eroded accordingly. Public trust in core institutions—such as Congress, the judiciary, and the media—is at historic lows.

4. Ungoverned AI. Breakthroughs in artificial intelligence will move much faster than governance efforts.

5. Axis of rogues. Deeper alignment and mutual support between Russia, Iran, and North Korea will pose a growing threat to global stability.

6. No China Recovery. Any green shoots in the Chinese economy will only raise false hopes of a recovery as economic constraints and political dynamics prevent a durable growth rebound.

7. The fight for critical minerals. The scramble for critical minerals will heat up as importers and exporters intensify their use of industrial policies and trade restrictions.

8. No room for error. The global inflation shock that began in 2021 will continue to exert a powerful economic and political drag in 2024.

9. El Nino is back. A powerful El Nino climate pattern will bring extreme weather events that cause food insecurity, increase water stress, disrupt logistics, spread disease, and fuel migration and political instability.

10. Risky business. Companies caught in the crossfire of US culture wars will see their decision-making autonomy limited and their cost of doing business rise.

The Eurasia Group's Top Risks for 2024

15.3. Economic News Agency "PRIME"

1. Economy and investments – United States, India, China and Russia. In 2024, a stable US economy could propel the stock market to a 15% growth. This potential could be further amplified by favorable factors like sustained investment inflows from emerging markets, decelerating inflation, and controlled debt growth.

Conversely, investments in the Chinese economy currently appear less appealing compared to the anticipated US market growth. The trajectory of the Chinese economy remains uncertain, clouded by geopolitical tensions and internal challenges. Domestic market data provides an unclear picture of the future. The Chinese economy faces structural issues including sluggish business activity, high youth unemployment, declining exports and imports, and concurrent deflationary pressures.

The Indian stock market remains a compelling investment destination this year. Indian companies are experiencing robust share growth driven by rising profits and strong investor interest. Furthermore, India is witnessing a surge in foreign companies relocating production from China, establishing new facilities or expanding existing ones within the country. This trend positions India as an "island of stability" for international investors amidst emerging market uncertainties. India's GDP is projected to grow at 6.3% for the fiscal year 2023-2024. Long-term growth drivers for the Indian economy include a relatively low urbanization rate (less than 40% of the population resides in cities) and a large youthful demographic.

The Russian Ministry of Economic Development forecasts economic growth of 2.3% in 2024 and 2.2% in 2026. Despite increased Western sanctions pressure stemming from the Ukraine conflict, Russia's economy continues to demonstrate resilience. These sanctions have, however, contributed to rising energy prices (electricity and fuel) and food inflation in Europe and the United States.

2. Food crisis. Global food prices are surging, accelerating food inflation. This, coupled with pre-existing high debt levels in many countries and unprecedented inflation rates, presents significant economic challenges. The pace of global trade recovery, particularly in the areas of exports and imports of services, will be crucial in mitigating these challenges.

3. Impact of US sanctions on the world economy. The excessive use of U.S. sanctions is disrupting global trade flows and altering the structure of the global economy, which will likely exacerbate global inflation. In January, the IMF downgraded its forecast for global trade growth in 2024 to 3.3% and in 2025 to 3.6%. The current international trade system is ill-equipped to address trade disputes rooted in national security concerns. This, coupled with the weakest global growth prospects in decades, poses significant challenges to the world economy.

4. US government debt. The escalating U.S. government debt poses a significant threat to the global economy. According to the Roscongress Foundation, the U.S. national debt has surpassed $34 trillion. Servicing this debt is projected to require annual expenditures of $1 trillion in the near future. Such a substantial debt burden carries risks for both the global financial system and the broader world economy.

5. The Middle East and other potential hotspots in the world. Yemen, along with other states, including the wealthiest monarchies of the Gulf, faces an increasing likelihood of being drawn into the escalating conflict in the Middle East. The ongoing crisis in the Red Sea poses the risk of sparking another surge in oil prices and intensifying confrontations within this critical region. While Iran's decision to refrain from active involvement at the onset of the crisis offers some reassurance, the potential for escalation remains significant. A clash of interests between the West and the Islamic world could trigger a chain reaction in the region at any moment. Meanwhile, the Korean Peninsula and the Indo-Pakistan border continue to represent other potential flashpoints on the Eurasian map.

6. Climate. The year 2024 is on track to become the hottest year on record. This unprecedented heat is primarily driven by the natural phenomenon of El Niño. The significant temperature rise will have far-reaching consequences. Accelerated ice melt will disrupt the North Atlantic Current, potentially leading to more severe storms in Europe. Warming temperatures will severely impact agriculture, particularly in drought-prone regions such as East Asia, southern Africa, and Central America. Human activity is further exacerbating this crisis. Experts predict that the average global temperature in 2024 will surpass pre-industrial levels by 1.3-1.6oC, a concerning increase.

Source: Economic News Agency PRIME

15.4. Risks 2024 according to the World Economic Situation and Prospects report

Projections of the UN analysts are discouraging - a protracted period of low growth is looming for the world economy. Persistently high interest rates, further escalation of conflicts, sluggish international trade, and increasing climate disasters, pose significant challenges to global growth and to the achievement of the SDGs. Global economic growth is projected to slow from an estimated 2.7 per cent in 2023 to 2.4 per cent in 2024. The prospects of a prolonged period of tighter credit conditions and higher borrowing costs present strong headwinds for a world economy saddled with debt, while in need of more investments to resuscitate growth, fight climate change and accelerate progress towards the SDGs. The growth rates in most developing regions are projected to be slow or moderate. The least developed countries are projected to grow by 5.0 per cent in 2024, still well below the 7.0 per cent growth target set in the SDGs. Cascading global crises and slowed down economic growth may undermine progress towards the SDGs, including poverty reduction efforts. While global poverty marginally declined in 2023, in low-income countries poverty rates remained well above pre-pandemic levels. UN analysts consider that escalating geopolitical tensions, tighter monetary and fiscal conditions, and weakened global trade pose risks for the socio-economic development.