Section 12. Thematic reviews

12.5. Green Hydrogen: Global and Central Asian Development Trends

The review was prepared by M. Valieva, D.R. Ziganshina (SIC ICWC)

In recent decades, the global community has grappled with the pressing challenge of climate change, necessitating significant societal transformations. This includes a decisive shift away from fossil fuels towards renewable energy sources (RES), increased energy efficiency, and widespread electrification. In this context, green hydrogen – hydrogen produced using renewable energy – emerges as a pivotal component in the transition to a decarbonized future.

Green hydrogen, as a relatively new technology, is subject to intense scrutiny. Many aspects of its production remain unclear or insufficiently studied, including land use implications, actual greenhouse gas emissions, and the potential to extend the lifespan of fossil fuel power plants. This thematic review offers a concise overview of global and Central Asian trends in green hydrogen development, with a particular focus on its potential impact on water resources.

Hydrogen and its typesы

Hydrogen is the most common chemical element on Earth, which is found in water, air and solids. In world practice, there is a conditional classification of hydrogen by color, depending on the environmental friendliness of the process of its production. They distinguish:

• gray hydrogen, which produces the largest amount of carbon dioxide from coal or methane;

• pink/red/yellow hydrogen produced by atomic energy;

• turquoise/blue hydrogen produced from natural gas using Carbon Capture, Utilization and Storage (CCUS) technology or without carbon dioxide release (experimental pyrolysis);

• green hydrogen, which is produced by electrolysis of water using electricity produced from renewable energy sources. It is considered the most environmentally friendly and clean.

There are other types of hydrogen classification, including "low carbon hydrogen", which refers to hydrogen based on fossil fuels with CO2 capture and hydrogen based on electricity.

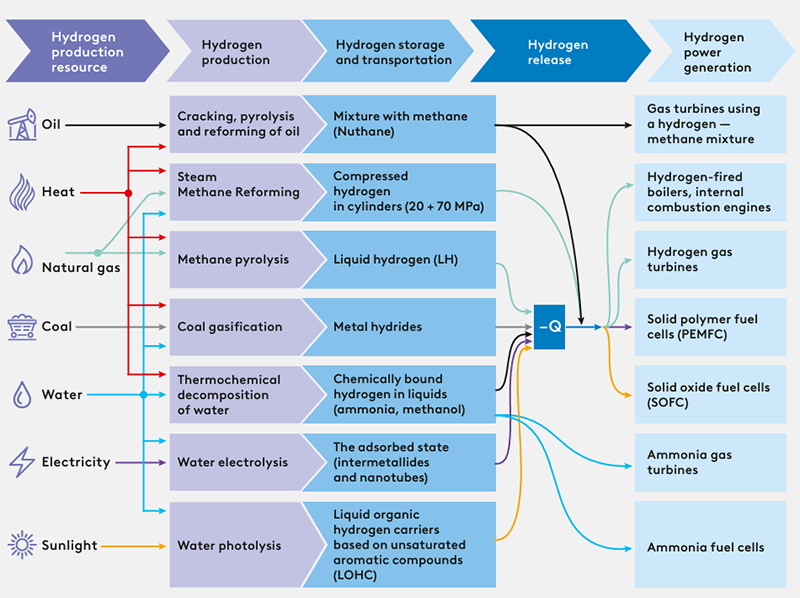

Currently, hydrogen production worldwide is predominantly based on organic fuels—natural gas, coal, and oil—accounting for 96% of total production. Only 4% of hydrogen is produced through water electrolysis. Figure 1 illustrates the main technological pathways of hydrogen energy, from production to its utilization as an energy carrier.

However, with the growing need to transition away from fossil fuels, the demand for and production of green hydrogen is steadily increasing.

Source: Green Technologies for Eurasia’s Sustainable Future/

Edited by Evgeny Vinokurov.

Moscow: Eurasian Development Bank,

Global Energy Association, 2021

Growing demand for green hydrogen

Global hydrogen consumption in 2022 reached 95 million tons, representing an increase of nearly 3% compared to 2021. Significant growth was observed across all major consumer regions, except Europe, where industrial activity was impacted by a sharp rise in natural gas prices.

The International Energy Agency (IEA) estimates that global hydrogen demand could reach 115 million tons by 2030, with less than 2 million tons driven by new applications. This falls short of the 130 million tons (25% from new uses) required to meet countries' existing climate commitments and the 200 million tons needed by 2030 to align with achieving net-zero emissions by 2050. According to McKinsey's forecasts, demand for pure hydrogen could rise to between 125 and 585 million tons per year by 2050.

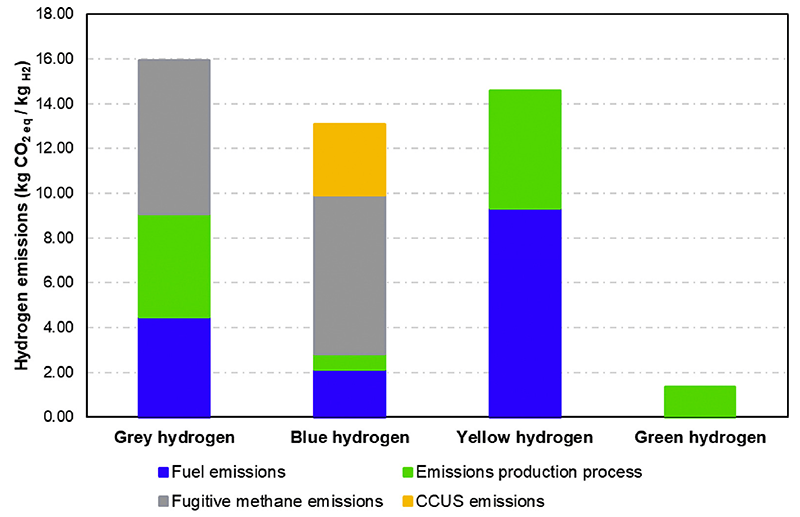

Comparison of emissions from various hydrogen (H2) production methods

Source: F.L.D. Simoes, D.M.F. Santos (2024), A SWOT Analysis of the Green Hydrogen Market

Green hydrogen: advantages and disadvantages

Like most energy sources, green hydrogen has both advantages and disadvantages. Among the key advantages of green hydrogen are the following:

• Environmental friendliness. Green hydrogen is produced using renewable energy sources such as solar, wind and hydropower, without the emmission of harmful greenhouse gases, which ensures its purity and sustainability as an energy source;

• Wide range of applications in various industries thanks to its versatility and stability. Green hydrogen can provide fuel for such hard-to-carbonize heavy industries as steel, chemical and cement industries that cannot use solar or wind energy, shipping, aviation and ammonia production. A higher energy density than that of batteries makes it possible to use hydrogen for long-haul freight transportation;

• The possibility of storage and use as an energy carrier. During peak production periods, excess electricity generated from the sun and wind can be used to produce hydrogen, which can be stored indefinitely. When production levels drop or demand increases sharply, the generator converts the stored hydrogen into electricity, which is supplied to the grid, ensuring a continuous and stable energy supply . In addition, hydrogen can be used as a clean fuel for various types of transport, such as cars, trucks, buses and even hydrogen fuel cell trains. Fast refueling capabilities make green hydrogen a viable alternative to fossil fuels.

• The possibility of transportation through the existing infrastructure. Like natural gas, green hydrogen can be safely delivered to the end user through a pipeline. Using the existing natural gas supply network and laying new pipelines where necessary, it is possible to create a reliable national transportation network for hydrogen, the carbon-neutral energy carrier of the future. In particular, Gasunie, which is engaged in the safe transportation of natural gas throughout the Netherlands, has also accumulated many years of experience in transporting hydrogen between two companies in the province of Zealand through an existing decommissioned gas pipeline .

• The highest efficiency of all types of pure hydrogen in terms of water use. On average, hydrogen production by electrolysis with a proton exchange membrane (PEM) has the lowest water consumption - about 17.5 l/kg. This is followed by alkaline electrolysis with a water consumption rate of 22.3 l/kg. For comparison, the method of steam conversion of methane – carbon capture, utilization and storage (SMR-CCUS) - uses 32.2 l/kg, and autothermal reforming (ATR)-CCUS uses 24.2 l/kg .

Despite the many advantages of green hydrogen as an energy source, its potential disadvantages must also be taken into account:

• Higher cost of green hydrogen production compared to hydrogen derived from fossil fuels. This cost disparity stems from the high expense of renewable energy sources and the technological processes involved in water electrolysis. For instance, electrolyzers can cost up to six times more than natural gas-based equipment. The production cost of green hydrogen ranges from $2.5 to $5 per kilogram, compared to $1.50–$3.50/kg for blue hydrogen and $1.50/kg for gray hydrogen. According to the IEA's 2019 analysis, producing hydrogen from fossil fuels is expected to remain the most cost-effective option until 2030. Lowering the production cost of green hydrogen is essential for scaling up access to clean hydrogen. High production costs for green hydrogen pose a significant challenge to the European Union's ambitious goals as a leading player in the hydrogen market. Under the REPowerEU plan adopted in 2022, Europe aimed to produce and import 10 million tons of green hydrogen by 2030. However, in April 2024, the CEO of TotalEnergies stated at the World Economic Forum that achieving these targets is unrealistic due to the nascent stage of market development and the high costs associated with green hydrogen production. The European Court of Auditors has confirmed that the EU's aspirations are based on "political will" and not on realistic assessments .

• The cost of hydrogen. In July 2024, FTI Consulting presented a "Green Hydrogen Global Market Price Model" with calculations of the cost of producing and delivering green hydrogen in various ways, including marine transport and pipeline systems. According to the data, by 2030 the average price of green hydrogen may reach $5.3 per kg . The Dutch Institute TNO conducted (2024) a study of prices for hydrogen production in the Netherlands, analyzing 14 projects implemented by 11 major market participants. It turned out that the cost of European-made electrolysis plants is significantly higher than expected: €3,050 per kW for a 100 MW plant and €2,630 euros per kW for 200 MW. In recent years, production costs for green hydrogen have risen due to increases in energy prices, material and labor costs, higher interest rates, and transportation tariffs. Consequently, the current price of green hydrogen in the Netherlands ranges from €12 to €14 per kilogram, significantly exceeding initial forecasts.

• Problems of hydrogen storage systems. The shift toward large-scale industrial production of green hydrogen, coupled with its widespread distribution, could address the challenge of storage. According to the EnergyNet research center, a significant reduction in the cost of storing liquefied hydrogen is anticipated globally after 2025, with prices expected to nearly halve from $2 to $0.9 per kilogram. Storing hydrogen in the form of ammonia is projected to be the most economical option, with storage costs dropping to approximately $0.1 per kilogram by 2025.

• High power consumption. The production of hydrogen, particularly green hydrogen, requires more energy compared to the production of other fuels.

• Large volume. The volume of green hydrogen is nearly four times larger than that of natural gas. To store green hydrogen, it must either be compressed to a pressure 700 times higher than normal atmospheric pressure or cooled to -253°C, which is close to absolute zero.

• Infrastructure. Hydrogen atoms are small and can sometimes seep through steel. Therefore, some existing pipelines may need to be upgraded.

• Significant amounts of water used for electrolysis, which poses a problem for water-scarce regions. Water is required not only as a raw material for production but also for cooling in all types of hydrogen production. The water consumption for producing 1 kg of renewable hydrogen ranges from 20 to 30 liters per kilogram (untreated water). OECD estimates this as about 1 billion liters annually with a production goal of 40 million tons per year, which is one of the targets for increasing pure hydrogen production by 2030.

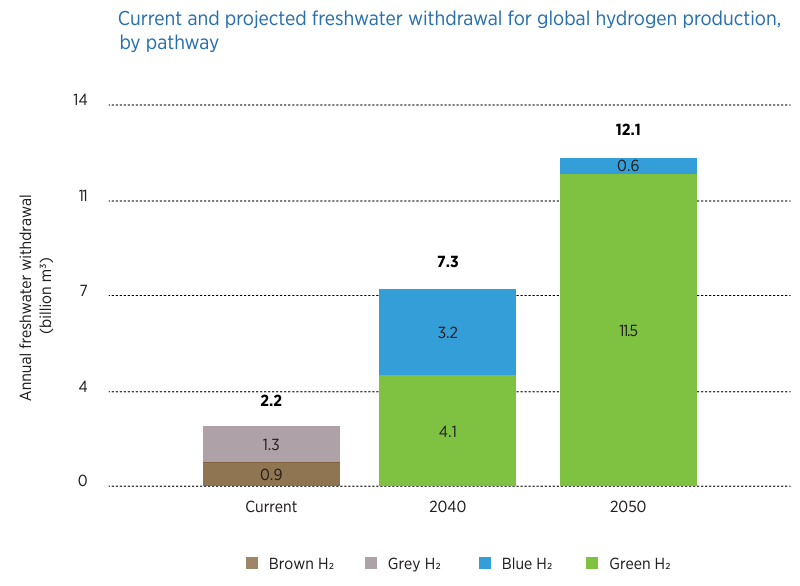

According to IRENA, approximately 2.2 billion m3 of freshwater are used annually for global hydrogen production, accounting for 0.6% of the total volume of freshwater withdrawn by the energy sector.

Gray hydrogen production accounts for about 59% of the world's freshwater consumption, while brown hydrogen accounts for 40%, with the remainder attributed to green and blue hydrogen. Freshwater consumption for global hydrogen production could more than triple by 2040 and increase sixfold by 2050 compared to 2023 (see Figure 4). .Additionally, rising water demand for hydrogen production may intensify competition between sectors, such as agriculture and household consumption, potentially threatening food security and impacting the well-being of populations.

Source: IRENA and Bluerisk (2023), Water for hydrogen production,

International Renewable Energy Agency, Bluerisk, Abu Dhabi, United Arab Emirates

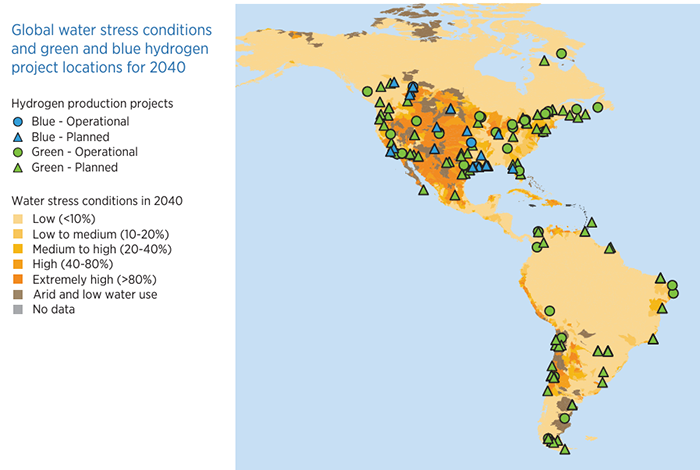

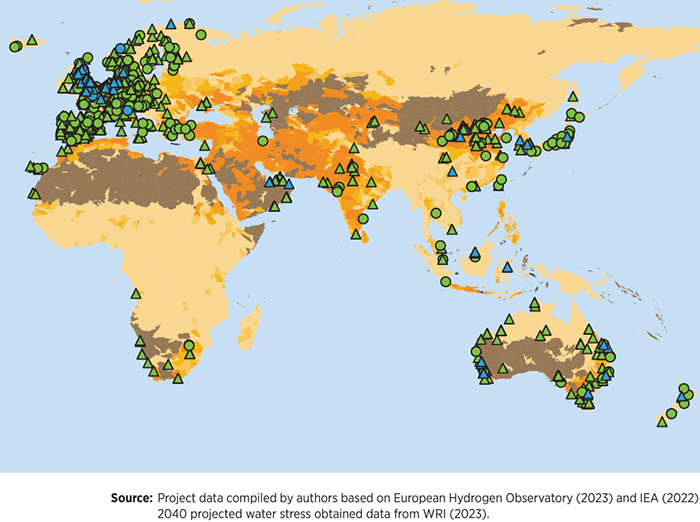

Although the use of deionized water produced by desalination plants can reduce the need for fresh water, it also causes the need to discharge residual brine into water sources and soil . In addition, despite the generally insignificant use of water for hydrogen production at the global level, it is important to take into account local conditions. More than 35% of the world's green and blue hydrogen production capacities (in operation and planned) are located in regions with acute water shortages.

Source: IRENA and Bluerisk (2023), Water for hydrogen production,

International Renewable Energy Agency, Bluerisk, Abu Dhabi, United Arab Emirates

• Low demand for green hydrogen. Experts suggest that the high cost of equipment required for hydrogen use and the challenges surrounding its supply infrastructure have resulted in a lack of significant demand. In particular, the passenger car sector saw a 30.2% decline in global sales of hydrogen fuel cell vehicles in 2023 compared to 2022. Additionally, a recent study indicates that hydrogen fuel cell trucks are unlikely to compete with electric vehicles on cost. . In 2024, McKinsey revised its forecast for the hydrogen market's development through 2050, reducing it by 10-25% compared to previous estimates. According to the updated report, hydrogen consumption by 2050 could range from 180 to 350 million tons per year, with 50-70% of this volume expected to be green hydrogen.

• Explosion hazard. Green hydrogen is a highly flammable substance, and its storage and transportation require the use of high-pressure containers and pipelines. In the event of leaks or explosions, these systems could pose a significant threat to public health and safety. Therefore, strict safety measures are essential to prevent such incidents.

• Impact on climate change. In the event of leakage into the atmosphere, hydrogen can enhance the heat-trapping effect of methane and act as a greenhouse gas, leading to the formation of water vapor in the upper atmosphere. Additionally, studies indicate that burning hydrogen in power plants increases the formation of nitrogen oxides (NOx), pollutants that contribute to smog, harm public health, and accelerate global warming. .

• Green hydrogen and hydropower plants. Environmental and human rights organizations warn that the growth of the green hydrogen industry could lead to a new wave of large-scale hydroelectric power plant construction worldwide. This trend is linked to significant environmental, social, and economic issues, including ecosystem destruction, displacement of populations, high capital costs, and the risk of man-made disasters. Environmentalists from the Rivers Without Borders Public Foundation, in their review of the draft Concept for the Development of Hydrogen Energy in the Republic of Kazakhstan, argue that the country’s energy-intensive hydrogen production is primarily aimed at justifying the construction of new energy facilities, such as large hydroelectric and nuclear power plants. These projects could have significant negative impacts on the environment and biodiversity. Reservoirs created for hydroelectric power plants are a source of greenhouse gas emissions, particularly methane, which in the near future will have an emissions impact 84 times greater than that of carbon dioxide. Therefore, to ensure the optimal use of hydroelectric power plants, careful planning and the development of strategies to minimize their negative impact while maximizing their benefits are essential.

Global development of green hydrogen

Given the potential of green hydrogen as an environmentally friendly and low-carbon method of energy production, storage, and transmission, many of the world’s leading countries have created opportunities for its development in recent years.

In 2017, Japan became the first country in the world to adopt a national hydrogen strategy, which was updated in 2023. The updated strategy identifies nine key technologies, including fuel cells and water electrolysis devices. It was also decided to invest more than 15 trillion yen ($98.8 billion) over the next 15 years and increase hydrogen consumption to 12 million tons per year by 2040 .

Germany plans to invest over €10 billion in the hydrogen sector by 2023, including €7 billion for "market launch" (creating framework conditions and stimulating domestic demand), €2 billion for international cooperation, and another €1 billion for the needs of the industry, which in turn is expected to implement hydrogen technologies to potentially become the world's largest exporter. The German government views hydrogen energy as the most effective way to utilize existing energy sources.

It is important to note that in recent years, there has been a shift in leadership within the hydrogen economy. The BRICS countries are taking the lead, showcasing significant achievements in technological development, project implementation, and the growth of domestic markets, as well as in the volume of export agreements.

China, as the world's largest hydrogen producer and with the world's largest renewable energy capacity, is striving to create an integrated hydrogen industry encompassing transportation, energy storage and the industrial sector. By 2035, the country plans to increase the share of green hydrogen in its energy mix. According to the "Green Hydrogen Energy Development Plan for 2021-2035," China aims to achieve annual hydrogen production from renewable energy sources of 0.1-0.2 million tons. At the same time, approximately 60% of the world’s electrolyser production capacity is concentrated in China, with costs significantly lower than those of European counterparts.

In 2020, South Korea set standards for clean hydrogen energy, and in 2021 it defined the criteria for certification of green hydrogen. The country is actively developing infrastructure for hydrogen vehicles, charging stations and fuel cells for the mass deployment of hydrogen technologies.

As of 2020, 99% of hydrogen in the USA was produced from fossil fuels. To stimulate the production of "clean hydrogen" (produced with low or zero carbon emissions), the Bipartisan Infrastructure Law was passed in 2021, allocating over $9.5 billion in direct investments for clean hydrogen initiatives. In 2022, the tax credit for its production was reduced. In 2023, the National Strategy and Roadmap for Clean Hydrogen were adopted.

The Hydrogen Strategy of the European Union, adopted in 2020 (COM/2020/301), established a foundation for supporting the production and use of renewable and low-carbon hydrogen. The European Union plans to invest $430 billion in clean hydrogen by 2030.

In 2023, India approved the National Mission for Green Hydrogen with the goal of producing at least 5 million tons of clean hydrogen annually, accompanied by an increase in renewable energy capacity of 125 GW through over €2.24 billion in investments.

The Ministry of Energy of the Russian Federation has developed a Roadmap titled "Development of Hydrogen Energy in Russia" for 2020-2024, which served as the foundation for the Action Plan approved by RF Government Decree No. 2634-r on 12.10.2020. Russia plans to produce and export hydrogen in line with the global trend of phasing out hydrocarbon energy. The country’s competitive advantages include its vast energy reserves, proximity to potential consumers (such as EU countries, China, and Japan), and the existing transportation infrastructure.

Central Asian development of green hydrogen

Kazakhstan is an energy-surplus country and an important regional exporter of coal, oil, and gas, with growing production rates. Coal dominates the electricity and heat supply, contributing to a relatively rapid increase in greenhouse gas emissions. The variety of resources available in the country for low-carbon hydrogen production presents opportunities for synergy and the accelerated development of Kazakhstan's hydrogen economy, driven by economies of scale.

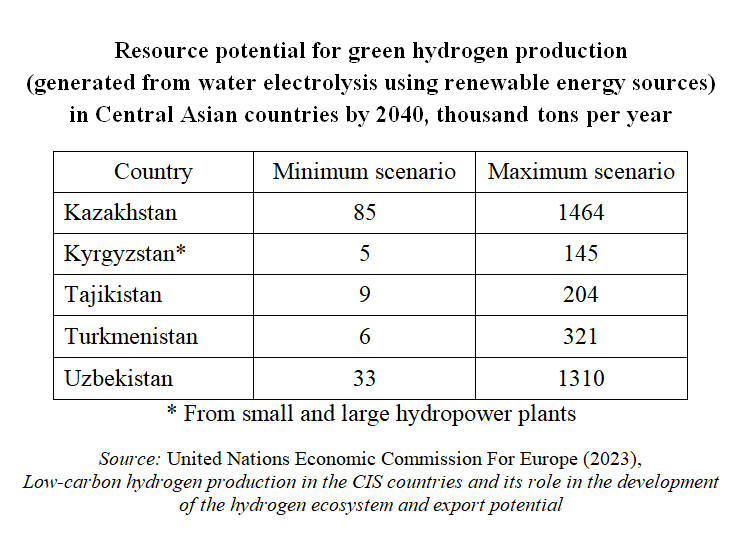

The development of hydrogen energy in Kazakhstan can help balance the intermittent electricity production from renewable energy sources, meet electricity demand, and enhance network stability, while also contributing to the decarbonization of various emission-intensive sectors (such as industry, transport, and energy). According to UNECE forecasts, the potential for hydrogen production from water via electrolysis using renewable energy sources in Kazakhstan by 2040 ranges from 85 to 1,464 thousand tons.

In line with the Strategy for Achieving Carbon Neutrality of the Republic of Kazakhstan by 2060 and the National Development Plan through 2025, the country has approved the Concept of Hydrogen Energy Development until 2030. The document highlights hydrogen as a key element in the transition to a low-carbon economy, with the potential to decarbonize industrial processes and transport. The expected outcome of the Concept is to achieve hydrogen production of 10 thousand tons by 2027. By 2029, the planned production volume is expected to reach 18 thousand tons per year, with a target of 25 thousand tons by 2030, with at least 50% of that being green hydrogen. A key goal is also to reduce carbon dioxide emissions by 0.1% by 2030 through the use of hydrogen across various sectors of the economy. Additionally, Kazakhstan plans to export 15 thousand tons of hydrogen per year to partner countries by 2030. As part of international cooperation, five agreements on joint hydrogen energy projects are expected to be concluded by 2030. The introduction of hydrogen buses is also planned for at least three cities by that date.

A Competence Center for Hydrogen Energy was established under the National Company KazMunaiGas, which has been functioning as a research hub for hydrogen energy technologies since April 2022. In 2021, a Framework Agreement was signed between the Government of the Republic of Kazakhstan and NEH Eurasia GmbH (Germany) on the basic principles for implementing renewable energy projects and producing green hydrogen in the Mangystau region. The plan includes the construction of a solar and wind farm to generate 40 GW of electricity, which will be used for hydrogen production via electrolysis using desalinated water. Additionally, Kazakhstan and the European Union have signed a memorandum on strategic partnership in the fields of sustainable raw materials, batteries, and green hydrogen value chains.

Kyrgyzstan is an energy-deficient country, meeting only 51% of its electricity needs from domestic resources, primarily hydroelectric power plants. The country has significant potential for developing hydro and solar energy, which could be used to produce between 5,000 and 145,000 tons of low-carbon hydrogen per year. The relatively low cost of hydropower generation in Kyrgyzstan (2-2.3 cents per kWh) helps reduce the cost of producing green hydrogen. While there are currently no active green hydrogen projects in Kyrgyzstan, the President has expressed interest in developing cooperation with Germany in the field of green hydrogen production and use.

Tajikistan is an energy-deficient country with limited fossil energy resources, but it meets 90% of its electricity needs through hydropower. The country possesses vast potential in hydropower, though it has not yet explored its solar energy potential. The estimated share of the country’s territory that could be covered by photovoltaic installations to generate the equivalent of the annual electricity consumption is just 0.074%. With the development of these resources, Tajikistan is projected to have the potential to produce between 9,000 and 204,000 tons of low-carbon hydrogen per year by 2040. According to the leadership of the Ministry of Energy and Water Resources, Tajikistan plans to produce 1 million tons of green hydrogen annually by 2040, both for domestic consumption and exports to Central Asian countries. Currently, no projects have been completed.

Turkmenistan is an energy-rich country and a major exporter of natural gas, which dominates its energy sector, accounting for nearly 100% of electricity production. The share of renewable energy in the country's energy mix remains minimal. However, Turkmenistan holds significant potential for low-carbon energy production. Blue hydrogen can be produced from natural gas using carbon capture, utilization, and storage (CCUS) technologies. The country's relatively modern gas pipelines present opportunities for hydrogen injection and retrofitting. Additionally, by harnessing its untapped renewable energy resources, including offshore wind in the Caspian Sea, Turkmenistan could establish green hydrogen production through water electrolysis powered by renewable energy. Projections estimate that the country could produce between 6,000 and 321,000 tons of hydrogen annually, paving the way for a sustainable energy future. Low-carbon hydrogen could replace petroleum products in the transport sector and position Turkmenistan as a key player in future export projects, particularly to markets like China. Since 2022, a draft "Roadmap for the Development of Green Hydrogen Energy in Turkmenistan" has been under discussion. However, no projects have been implemented yet.

Uzbekistan is an energy-rich country, a major producer and exporter of natural gas, and a significant producer of oil and coal to meet domestic demand. The country also possesses substantial potential for renewable energy, particularly solar power, with a technical capacity estimated at 180 million tons of oil equivalent. According to the UNECE, Uzbekistan's resource potential for green hydrogen production, based on its available resources and energy sources, ranges between 33,000 and 1,310,000 tons annually.

Uzbekistan is actively pursuing a transition to a green economy and implementing reforms in its energy sector, including expanding the use of renewable energy sources and fostering the stable development of hydrogen energy. As part of the "Roadmap for the Transition to Low-Carbon Energy” in the Uzbek electric power sector—developed with support from the EBRD and financing from Japan—plans include utilizing excess renewable energy production to support the growth of a hydrogen economy.

In 2021, the National Research Institute of Renewable Energy was established, building upon the International Solar Energy Institute of the Academy of Sciences under the Ministry of Energy. Within its structure, the institute includes the Research Center for Hydrogen Energy and laboratories dedicated to testing and certifying renewable and hydrogen energy technologies. The institute focuses on advancing priority areas such as expanding the use of renewable energy sources and promoting hydrogen energy. It also works on developing regulatory projects aligned with international standards. Furthermore, plans are underway to establish a Green Hydrogen Center with support from USAID.

Other institutes in Uzbekistan are also conducting groundbreaking research in hydrogen energy. For instance, a team of scientists from the Institute of Material Sciences of the Academy of Sciences of the Republic of Uzbekistan, led by Dr. R. Rakhimov, has developed a new photocatalyst with the potential to revolutionize green hydrogen production. This innovative catalyst achieves record efficiency of up to 95% when using solar energy. The process leverages the pulsed tunneling effect, enabling precise adjustment of radiation pulse parameters to match the energy required for water decomposition. This approach significantly enhances energy efficiency. Remarkably, the catalyst operates at steam temperatures as low as 93–98°C, compared to traditional methods that necessitate heating water to 900°C.

In 2022, the Ministries of Energy of Uzbekistan and Saudi Arabia, along with Saudi companies ACWA Power and Air Products, signed an agreement to advance research, development, and production of green hydrogen in Uzbekistan. By 2023, in collaboration with ACWA Power, construction began on a pilot green hydrogen production facility. In the first phase, with financing from the EBRD, the project aims to produce 3,000 tons of hydrogen annually. This hydrogen will be processed into mineral fertilizers using a 20 MW electrolyser installed in Chirchik, Tashkent region, and supported by a 52 MW wind power plant located at the existing Bash WPP in Gijduvan district, Bukhara region. In the second phase, 2.4 GW of wind energy will be harnessed to enable the production of 500,000 tons of green ammonia annually.

Conclusion

Green hydrogen holds strategic importance for global decarbonization and achieving the UN Sustainable Development Goals (SDGs), particularly in providing clean, affordable energy and combating climate change. The development of a green hydrogen economy is being actively pursued by countries like Japan, China, India, South Korea, the United States, and EU nations, which are making significant investments and advancing technologies in this field. Key drivers behind the development of green hydrogen energy include the need for decarbonization, its potential for export, and its contribution to energy security. However, its adoption faces challenges such as high production costs, significant water requirements, the need for substantial infrastructure development, and the creation of a viable sales market.

The key prerequisites for green hydrogen production include: availability of land resources for installing renewable energy infrastructure, favorable climatic conditions to support the development of renewable energy potential, access to water sources for electrolysis and cooling processes, a developed industrial infrastructure to facilitate domestic consumption, particularly industries already using gray hydrogen and with potential demand for green hydrogen, and transport connectivity to enable efficient hydrogen exports.

Central Asian countries possess favorable conditions for the development of green hydrogen energy. Among them, Kazakhstan and Uzbekistan, which have the greatest production potential (see Table 1), are already taking initial steps to advance this sector.

The successful development of green hydrogen requires a comprehensive approach, including the creation of a robust regulatory framework, advancement of technologies, establishment of necessary infrastructure, reduction of production costs, expansion of local demand for green hydrogen in key industries, and active international cooperation.

Development of sales markets. Currently, hydrogen exports from Central Asia face challenges due to the region's distance from key importers, such as the European Union, and the lack of direct access to the open sea. However, there is an opportunity to enter the Chinese market via a shared border, as well as potential access to the European market through cooperation with Russia and countries in the Caucasus. Export opportunities could also be expanded by leveraging the existing and promising gas transportation infrastructure.

Regional clusters. Experts suggest that, in the context of an actively developing renewable energy market across all Central Asian countries, regional cooperation will be a logical response to the growing competition in the export of green hydrogen. Such collaboration would allow for the most efficient use of existing infrastructure, optimizing it for green hydrogen exports, and enabling a greater utilization of renewable energy resources for its production. Central Asian countries can maximize the benefits of cooperation in green hydrogen if they coordinate their efforts and develop regional production clusters. This approach would also help diversify government revenues and reduce dependence on oil and gas exports. To achieve the most efficient production of green hydrogen and increase their share in the global market as exporters, these countries need to:

• promote the creation of a coordinated renewable energy development program among the countries in the region;

• develop a unified, transparent legislative framework to attract investments;

• adopt standardized technical requirements for green hydrogen infrastructure;

• establish joint training programs for new specialists, involving the private sector;

• create a regional distribution system for green hydrogen;

• upgrade power lines to ensure efficient transmission of electricity generated from renewable energy sources, thereby increasing the capacity for green hydrogen production.

The development of green hydrogen in Central Asia requires careful consideration of the relationship between water and energy resources. In water-scarce regions, it is important to address the need for water in hydrogen production, as well as the potential impacts of constructing hydropower plants. One promising approach is to explore the use of hydrogen as an energy storage solution for regulating the flow of transboundary rivers in the Aral Sea basin. Specifically, it is proposed to convert excess hydropower in Kyrgyzstan and Tajikistan, during periods of high water flow, into hydrogen for storage and later use.

To develop integrated, sustainable, and socially responsible green hydrogen projects, it is recommended to utilize strategic environmental and social assessment (SESA). This process evaluates the potential environmental and social consequences of green hydrogen policies, plans, or programs from a strategic perspective. The approach considers various types of infrastructure and incorporates environmental and social criteria for evaluating and licensing potential green hydrogen production projects and related facilities. Additionally, it is essential to develop appropriate measures to mitigate impacts and risks throughout the implementation of these policies, plans, or programs.